April 20 Work Session Summary

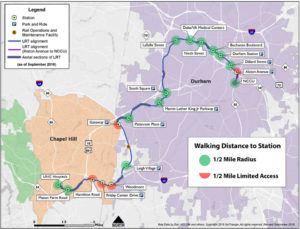

April 21 Update. The updated transit plan adds nearly $2 billion for the light rail project between UNC and Durham but does not add needed funds for bus service or bus rapid transit. As a result, bus hours have been cut by over 20% and the planned Bus Rapid Transit system from Eubanks to Southern Village along MLK, Columbia and 15-501 is not adequately funded and may not get built. The current trnait plan adds nearly a billion dollars in debt and over $900 million in interest to build the project, as well as additional debt in order to maintain the light rail service.

If the Commissioners were to adopt the current proposal, they will assume that Orange County’s sales taxes will grow uninterrupted by recession at 3-6% every year for the next 45 years. Yet the county’s consultant has told the commissioners that the plan is very, very risky for Orange County. If there’s an overage due to construction costs or interest rates, or if there’s a funding shortfall in sales tax, then the county will need make up the difference, most likely via the general fund (which is used for schools and essential services). The current estimated portion of project cost for Orange County is about $300 million.

April 20th Orange County work session. The Commissioners discussed the controversial Orange County Transit Plan, which has been updated to include commuter rail service between Durham and Wake County. They were presented with new scenarios that reduce the Orange County contribution and increase Durham’s with resulting favorable cash balances for Orange County – but mostly improves cash because GoTriangle is planning to borrow even more money and a private consortium has offered (but not committed) to provide additional funding via land donations – most of which has been added to Orange County’s side of the ledger.

The commissioners found it easy to be pleased that the numbers that worked, but surprisingly they didn’t ask any questions about the dubious tax revenue assumptions or construction cost assumptions that remain improbable.

There was some discussion about a possible award of federal funds when GoTriangle reported that neither Durham or GoTriangle would agree to give Orange County an exit strategy in case of a short fall in sales tax revenue or a change in service that didn’t work for the county. Commissioners are open to alternative contract language – but “as long as it doesn’t interfere with the project moving forward”.

The risks haven’t really changed – but on paper there is now a project scenario that looks good to the commissioners politically. It’s important to notice that in the work session the commissioners did not openly discussed likely scenarios where the sales taxes don’t grow as expected.

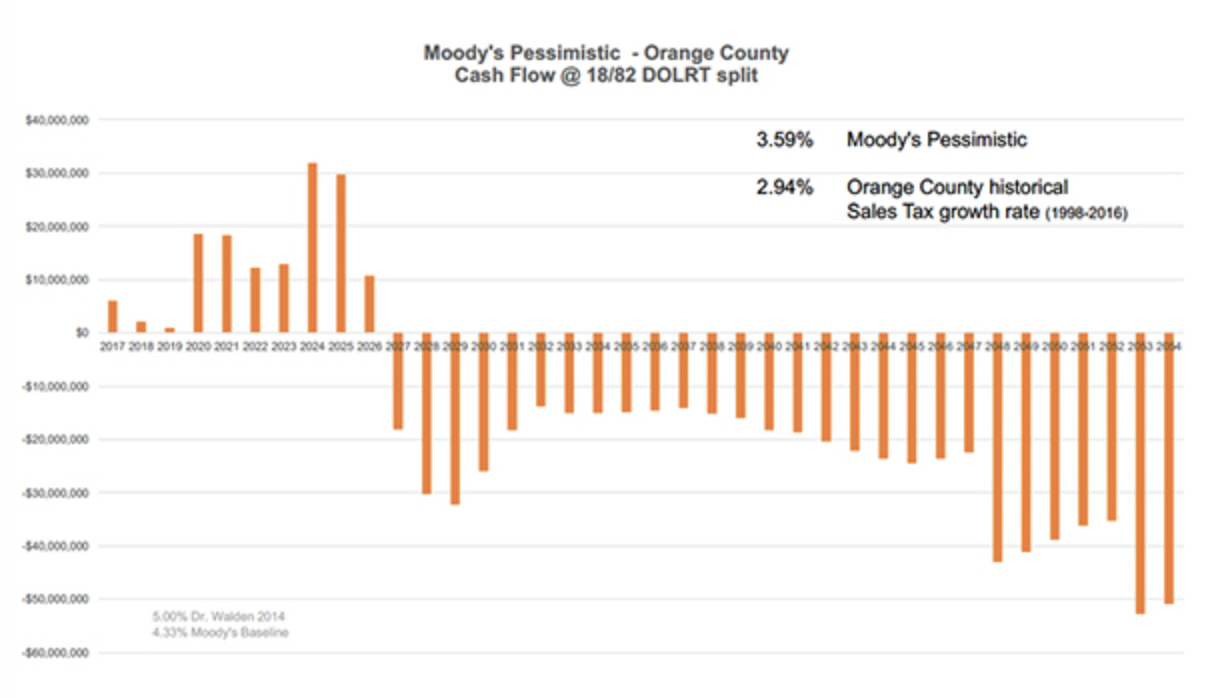

If you recall, the Board specifically requested on April 4th that the Consultant run a scenario using the more realistic forecast (intentionally labeled) “Moodys Pessimistic”. That has not happened yet! The graph below illustrates this scenario and shows what will happen to Orange County cash reserves using these more realistic assumptions. This is not good news for Orange County because even the Moodys Pessimistic forecast is well above Orange County’s historical sales tax growth rate from 1996 to 2016.

It’s discouraging to observe that in the well attended April 4th public session the Commissioners expressed great concern about the risky revenue assumptions. Yet none of this concern was evident at the April 20th work session and no one asked what would happen if the sales taxes don’t grow as expected. Commissioners Mark Dorosin, Mia Burroughs, Mark Marcoplos, and Penny Rich found the more favorable and unrealistic scenarios presented at the work session “workable”.

Commissioner Barry Jacobs made an impassioned call for fiscal responsibility and for the Board to sign an agreement that will protect the County from undue risk. That’s a position the entire Board needs to take. So far only Commissioner Earl Mckee and Renee Price have found this plan to be fiscally irresponsible a position with which we agree.

Read Tammy Grubb’s article here.

If Moody’s more pessimistic assumptions are used, Orange County will not have enough transit tax revenue to cover commitments.

April 18th Orange County public hearing. This commission discussion followed a jam packed public hearing (video link). Slightly more that half the public statements opposed the light rail. (The County archive contains additional comments and the majority runs strongly opposed to the rail project.) Many of the critical comments at the public hearing focused on the concern about the 3.3 billion dollar price tag. GoTriangle has had to resort to risky long term borrowing to try to make the project feasible. The counties will have to repay $1.25 billion of this debt with no state or federal help, including about $900 million in interest alone. These debt payments will consume Orange County our transit funds until 2062. See video links to all the comments made at the hearing.

On April 27, the Orange County Commissioners will decide whether to commit to funding the Durham Orange Light Rail Transit (DOLRT). Here are the risks to this plan:

- County taxpayers will be committed to a $935 Million dollar debt for 45 years to pay for the Durham Orange Light Rail.

- Light Rail will serve few Orange County residents leaving working families, seniors and low-income communities without access to transportation.

- Orange County bears the financial risk disproportionally on Orange County because there are few development opportunities for Orange County development and the plan consumes the entire transit tax for the next 40 years.

- Downturns in the economy or misses in optimistic assumptions will have a deleterious effect on County funds for schools and affordable housing.

- Almost all of the dedicated 1/2 cent sales transit tax monies will go to paying for light rail and long-term and short-term debt so other needed public transit will not be implemented.

A majority voted for a special designated transit tax in 2012 because transit is important to Orange County residents. We want the best value for the tax money we are raising each year.

Follow Us